Credit cards have traditionally been a popular way for people to manage their finances, but they are no longer the only option for essential purchases.

According to a report by NerdWallet, 25% of Americans have utilized buy now, pay later programs, with about 1 in 3 using them for necessary expenses.

The Consumer Financial Protection Bureau reported a significant increase in the use of buy now, pay later programs during the pandemic. Recently, the CFPB issued new regulations to ensure that these services offer similar consumer protections as credit cards.

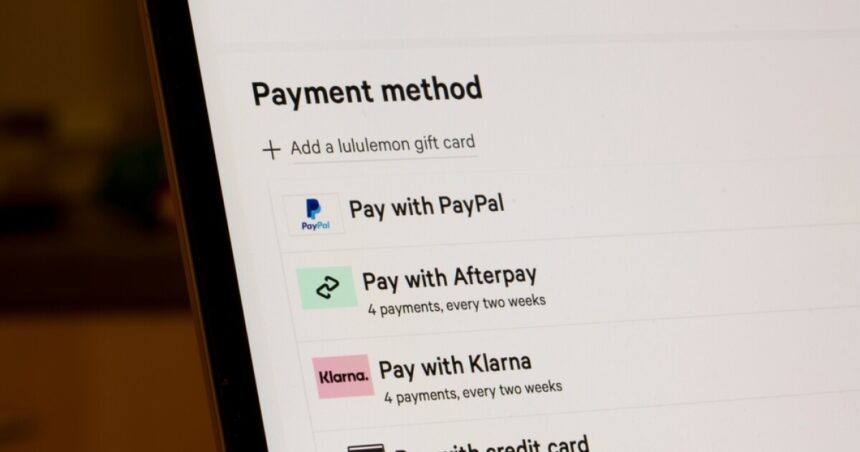

Unlike credit cards with high interest rates, buy now, pay later programs typically do not charge interest but split payments into monthly installments.

However, consumer advocates are worried that these programs could lead more people into debt by enabling them to buy items they cannot afford. NerdWallet expert Sara Rathner cautioned, “This convenience can work against you if you’re taking on more debt than you can realistically pay off.”

Economy

Americans add $184 billion in debt; more credit card accounts delinquent

6:24 AM, May 15, 2024

While more Americans use credit cards to cover essentials, the number using buy now, pay later programs is still lower. NerdWallet reports that 1 in 3 Americans have used a credit card for essential expenses in the past year, with 66% using credit cards overall.

Rathner highlighted the significance of how credit usage reflects overall financial health, noting the varying costs and benefits of different credit options.

The report coincides with a rise in credit card max-outs, as indicated by the Federal Reserve Bank of New York. Data shows that maxed-out borrowers are more likely to miss payments compared to others.

Recent data also reveals a spike in credit card debt post-pandemic, following a brief decline when economic stimulus checks helped many Americans catch up on payments.