A bipartisan proposal to eliminate federal taxes on tips now has the support of both presidential candidates, much to the delight of workers who rely on tips as part of their income.

One of these workers is Marcus Johns, a delivery driver, who expressed his support by saying, “They’re already taxing us everywhere else. Why are they taxing on tips? It’s a good initiative to eliminate that tax.”

Both presidential candidates have pledged to get rid of federal taxes on tips.

Vice President Kamala Harris made this commitment during a recent event in Las Vegas, where many casino employees depend on tipped wages for their livelihood.

She stated, “When I am president, we will continue our fight for working families of Americans, including to raise the minimum wage and eliminate taxes on tips for service and hospitality workers.”

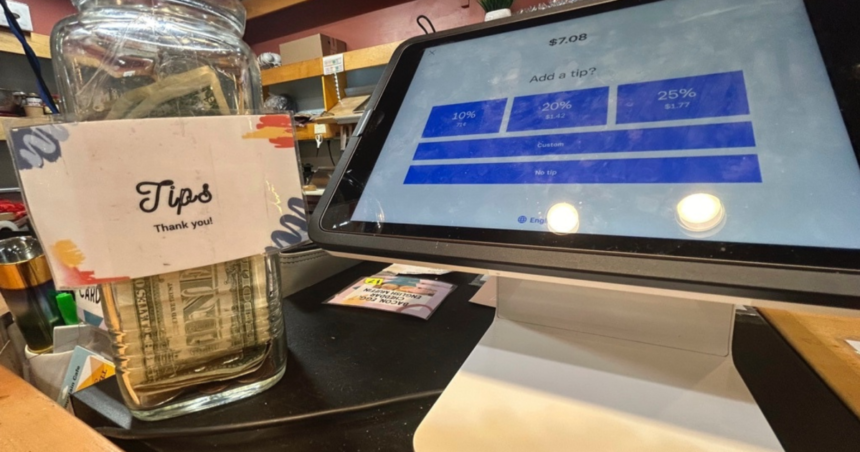

RELATED STORY | Tipping frustration reaches the boiling point: Is there a solution?

Former President Donald Trump also promised to remove taxes on tips during a rally in June, stating, “This is the first time I’ve said this, and to those hotel workers and people who get tips are going to be very happy, because when I get to office we are going to not charge taxes on tips.”

Trump reacted online to Harris’s proposal, claiming, “This was a Trump idea. She has no ideas, she can only steal from me.”

Research from Yale University’s Budget Lab shows that there were approximately 4 million tip workers last year, with 37% of them earning incomes low enough to be exempt from federal taxes in 2022.

The Committee for a Responsible Federal Budget estimates that exempting tips from income and payroll taxes could lead to a reduction in federal revenues by $150 billion to $250 billion over the next decade.

RELATED STORY | Trump is proposing to make tips tax-free. What would that mean for workers?