The American entrepreneurial spirit seems to be thriving despite high borrowing costs and consumers burdened by high prices.

New business applications are coming in at a monthly rate 48% higher than the 2019 average. This surge started right after the 2020 COVID-19 lockdowns and continues to grow in both total applications and those considered “high propensity,” which are businesses most likely to create jobs.

A wave of government funding during the pandemic, favorable programs, and strong consumer demand are some of the reasons for the sustained increase in new businesses. The growth of new businesses has likely contributed to the ongoing strength of the labor market, where job creation remains strong despite the Federal Reserve’s efforts to combat inflation through higher interest rates. However, new businesses should develop contingency plans to withstand ongoing high borrowing costs and weakening consumer spending as 2024 progresses.

Applications surge and remain high

In 2019, an average of 293,000 new business applications — measured by requests for employer identification numbers (EINs) from the IRS — were processed each month. This monthly measure reached its peak in July 2020 at 546,000. It slightly slowed down before peaking again at 503,000 in May 2021 and settling at the most recent 12-month average of 455,000.

These applications were not just driven by ambitious dreams concocted during lockdowns — high-propensity applications, those most likely to result in hiring workers, have also increased and continue to remain high.

The increases are likely due to a combination of factors: some new entrepreneurs being among the layoffs and business closures of spring 2020; Economic Impact Payments to households aiding in startup funding; pro-small business policies; and the unforeseen shift in life priorities that stemmed from the pandemic.

Increased filings lead to increased openings

Initially, there was some debate about whether these applications would actually lead to successful business creation, specifically if the aspirations of entrepreneurs would result in hiring employees. So far, the answer seems to be yes.

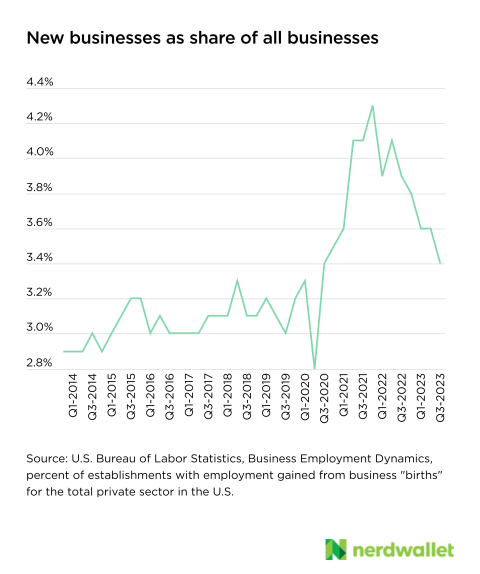

There is a lag between when a business applies for an EIN and when it is officially classified as a new business or one with employees on payroll. In 2018-2019, these establishment “births” made up 3.1% of all establishments, on average, each quarter. That percentage rose to 4.3% in late 2021 and currently averages 3.6% over the past year.

You can also see the increased presence of new businesses when looking at business age data — the share of establishments younger than 2 years modestly grew from 15.5% in 2013 to 16.7% in 2019 before experiencing a rapid increase over the following years. In 2023, the share of young businesses stood at 20.6%, based on data from the Bureau of Labor Statistics Business Employment Dynamics.

Funding is costly and harder to obtain

These young businesses are entering the market at a time when funding is expensive. Interest rates on new loans have nearly doubled over the past three years, according to data from the Kansas City Fed. This difference can mean hundreds of additional dollars in monthly payments and tens of thousands in interest over the loan’s lifespan.

New small business lending remained strong in the fourth quarter of 2023, as reported by the Kansas City Fed. However, banks have noted decreased demand for business loans in the first quarter of this year, according to the Federal Reserve. Additionally, a moderate number of banks report tightening standards on these loans in the most recent quarterly survey, making it more challenging for businesses to secure expensive funding.

What to expect for new businesses in the coming months

The remainder of 2024 may present challenges for new businesses. Borrowing costs are likely to stay high, and consumer spending may decrease.

The Federal Reserve is expected to start reducing interest rates until the third or fourth quarter of the year, and it will likely proceed cautiously. Therefore, new businesses should not anticipate significant relief from high loan interest rates throughout the year.

Furthermore, the Federal Reserve’s efforts to combat demand-driven inflation with higher rates are likely to start impacting household finances more in the upcoming months. This suggests that consumer demand for goods and services may not be as strong as it has been in previous years, as evidenced by recent data from the Bureau of Economic Analysis.

New businesses are more susceptible to fluctuations in consumer spending. On the other hand, established businesses may have loyal customer relationships that can help mitigate short-term changes in customer finances. Additionally, more established businesses typically have more resources and greater resilience to withstand slower business periods.

New business owners can prepare for the coming months by creating a strategy. Businesses dependent on discretionary spending should plan for lean times and consider setting up a line of credit as an emergency fund. It’s better to be prepared and not need it than to be caught off guard. Think about where expenses can be reduced, explore emergency funding options, and know where to seek assistance when navigating new economic challenges as a new business owner.

The article New Businesses Surge but May Be Tested This Year originally appeared on NerdWallet.